- ADAMS TAX FORM HELPER 2018 DOWNLOAD PDF

- ADAMS TAX FORM HELPER 2018 DOWNLOAD SOFTWARE

- ADAMS TAX FORM HELPER 2018 DOWNLOAD CODE

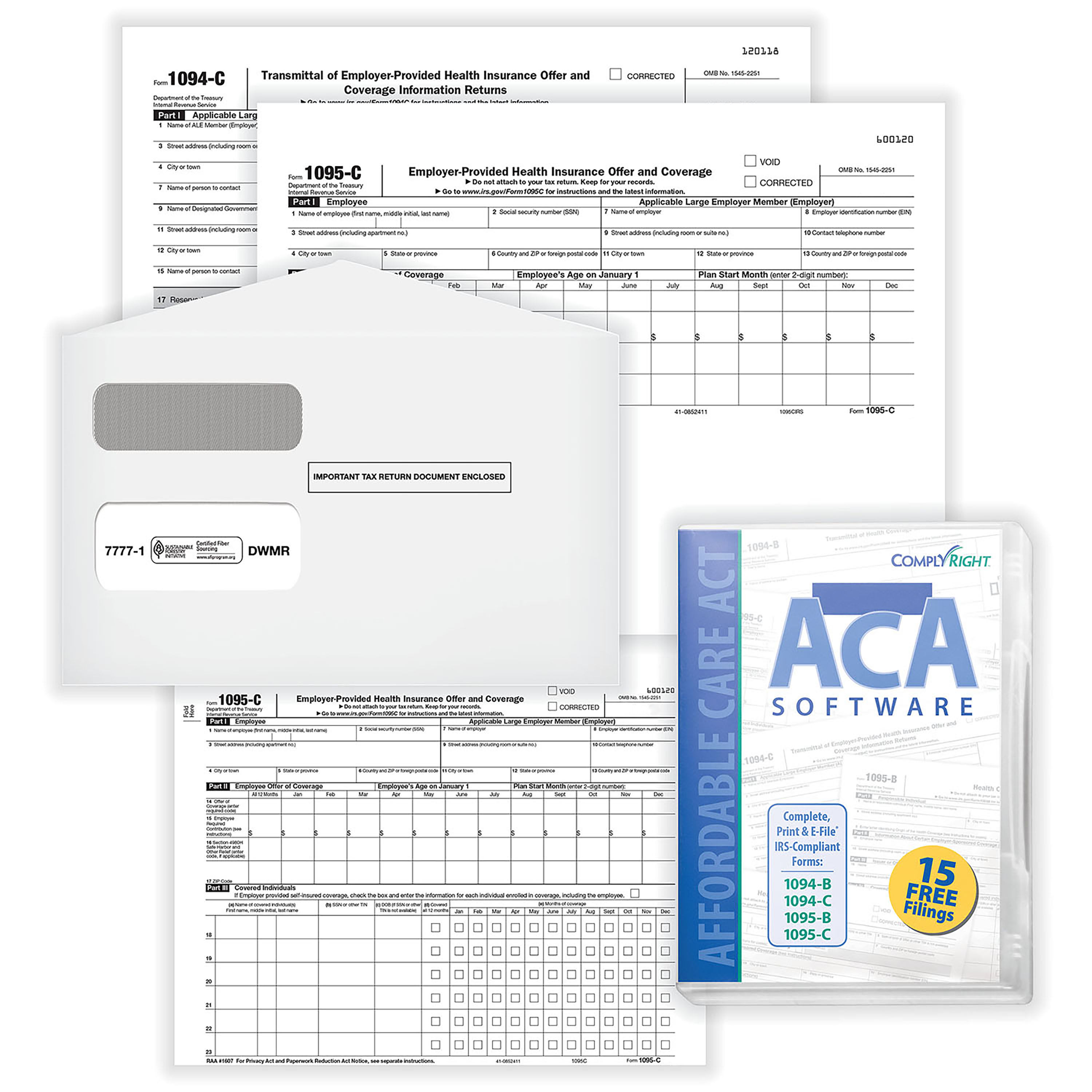

Whether you're a paper filer or eFiler, we give you the tools to make tax season a success.

ADAMS TAX FORM HELPER 2018 DOWNLOAD SOFTWARE

Tax Software Minimum System Requirements are as follows: Operating systems supported - Windo. You can also export your data from Tax Forms Helper to a spreadsheet (in the CSV format) and then. 400 North Street Harrisburg Pennsylvania 17120 Download File PSD Codes. If you are former user of Adams Tax Forms Helper and looking for new W2 1099 software then you can use W2 Mate to prepare W-2s, 1099-MISC along with the W- summary forms.

downloaded a form or printable document from the web, such as a The IRS tax.

ADAMS TAX FORM HELPER 2018 DOWNLOAD CODE

You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.īe sure to report each payment in the proper box because the IRS uses this information to determine whether the recipient has properly reported the payment. Adams Tax Forms Helper makes it easy to fill, print, mail or eFile your tax forms from our simple, secure site online. TaxRight 2021 Previously called TFP 5 free e-filings (e-file only original forms) Print/Mail. PA Resident Tax Form: PSD Code & EIT Rate Prefill As part of the Pennsylvania. Alexander Stangroom Assistant Designers: Sydney Adams, Taymoor Rehman Rules. Let our tax preparers keep up with these changes so you don’t have to.

In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment. Adams & Associates offers financial planning, tax planning, bookkeeping, tax preparation and accounting serving the South Hills, South Park, and surrounding Pittsburgh, PA areas.

File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year: At least $10 in royalties (see the instructions for box 2) or broker payments in lieu of dividends or tax-exempt interest (see the instructions for box 8) Īt least $600 in rents, services (including parts and materials), prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish, or, generally, the cash paid from a notional principal contract to an individual, partnership, or estate Any fishing boat proceeds or Gross proceeds of $600 or more paid to an attorney. Our on-site manager is proud of our community engagement, and through our website and mobile app, we keep everyone informed about area.

ADAMS TAX FORM HELPER 2018 DOWNLOAD PDF

Fill in, save, and print IRS form 1099-MISC in PDF format.

0 kommentar(er)

0 kommentar(er)